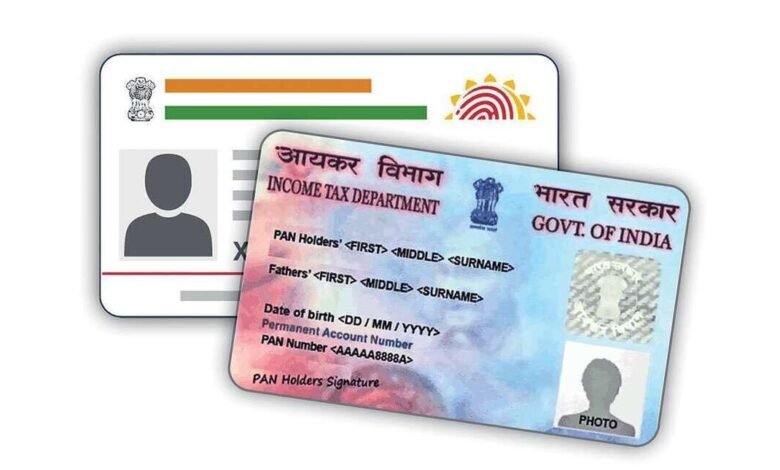

The Government of India has officially approved the PAN 2.0 Project, marking a significant upgrade to the existing Permanent Account Number (PAN) system. This initiative aims to modernize the PAN card by incorporating QR codes, enhancing its functionality and security. This article delves into the details of the PAN 2.0 Project, its implications for taxpayers, and how it aligns with India’s broader digital transformation goals.

Overview of the PAN System

The Permanent Account Number (PAN) is a unique identifier assigned to individuals and entities for tax purposes in India. It plays a crucial role in various financial transactions, serving as proof of identity and facilitating income tax filings. The current PAN system has been instrumental in curbing tax evasion and ensuring compliance among taxpayers.

Key Features of the PAN 2.0 Project

Introduction of QR Codes

One of the most notable features of the PAN 2.0 Project is the integration of QR codes into PAN cards. This advancement aims to:

- Enhance Security: QR codes will contain encrypted information that can be scanned for verification, reducing the risk of counterfeit PAN cards.

- Facilitate Quick Access: Users can quickly access their PAN details and related information by scanning the QR code, streamlining processes for both taxpayers and authorities.

Improved Data Management

The project is expected to improve data management by allowing real-time updates and corrections to PAN information. This will address common issues such as:

- Incorrect personal details on PAN cards.

- Delays in processing updates due to manual interventions.

Integration with Digital Platforms

The PAN 2.0 Project aligns with India’s push towards a digital economy. By integrating PAN with various digital platforms, such as e-filing systems and mobile applications, users will benefit from:

- Seamless Transactions: Enhanced interoperability between different financial services.

- User-Friendly Interfaces: Simplified processes for applying for or updating PAN details online.

Implications for Taxpayers

Compliance and Convenience

The introduction of QR codes and improved data management will significantly enhance compliance for taxpayers. The benefits include:

- Easier Verification: Financial institutions and government agencies can quickly verify a taxpayer’s identity using the QR code, reducing instances of fraud.

- Faster Processing Times: With real-time updates, taxpayers can expect quicker resolutions for any discrepancies in their PAN details.

Enhanced User Experience

The modernization efforts are designed to create a more user-friendly experience, making it easier for individuals to manage their financial identities. Key aspects include:

- Online Services: Taxpayers will have access to comprehensive online services for applying, updating, or correcting their PAN details without needing to visit physical offices.

- Mobile Accessibility: The integration with mobile platforms ensures that users can manage their PAN on-the-go.

Future Prospects

The PAN 2.0 Project is part of a larger vision to digitize financial services in India. As the government continues to invest in technology-driven solutions, we can expect further enhancements to the tax system that promote transparency and efficiency.

Conclusion

The approval of the PAN 2.0 Project represents a significant step forward in modernizing India’s tax infrastructure. By incorporating QR codes into PAN cards and improving data management systems, the government aims to enhance security, streamline processes, and provide a better experience for taxpayers. As India moves towards a more digital economy, initiatives like these are crucial in ensuring that citizens can navigate their financial responsibilities with ease and confidence. By staying informed about these changes, taxpayers can better prepare for the transition and take full advantage of the benefits offered by the upgraded PAN system.

For the latest updates on News and Current Trends, follow us on X/Twitter here.

Infornex is now on every popular social media. Follow us on your favourite one to never miss an update, click here.

For more Breaking News and Updates, click here.